Online stores face the critical challenge of securing customer payments while providing a smooth checkout experience. Secure online payment processing is essential to protect sensitive financial data and build trust with shoppers. Secure payment processing systems use encryption and tokenisation to safeguard customer information during transactions.

Payment gateways act as secure intermediaries between customers, merchants and banks. They authorise credit card payments and facilitate the safe transfer of funds. By integrating trusted payment service providers, online retailers can offer multiple payment options while maintaining high-security standards.

Compliance with industry regulations like PCI DSS is crucial for business handling online card payments. Adhering to these standards helps prevent data breaches and protects customers and merchants from potential financial losses.

Key Takeaways

- Implement advanced security measures, such as encryption and tokenisation, to protect sensitive customer payment data during online transactions.

- Integrate trusted payment service providers and gateways to facilitate secure and smooth transactions. Choosing the right payment gateway provider is crucial for balancing cost-effectiveness and robust security features.

- Comply with industry regulations and best practices, such as PCI DSS and GDPR, to safeguard customer data and build trust. Compliance helps prevent data breaches, protects customers and merchants from financial losses, and enhances the overall credibility of the online store.

Table of Contents

Understanding Payment Processing Fundamentals

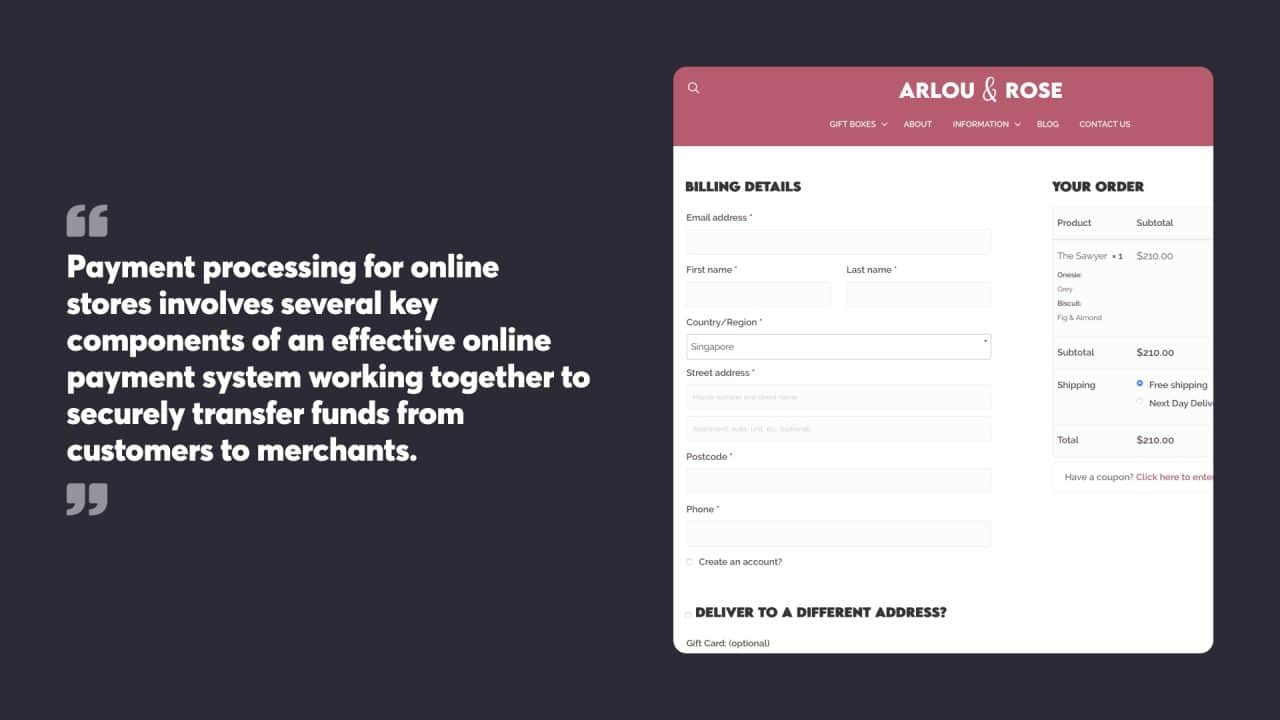

Payment processing for online stores involves several key components of an effective online payment system working together to transfer funds from customers to merchants securely. These components include payment gateways, merchant accounts, and payment processors, each playing a vital role in the transaction lifecycle.

What are Online Payments?

Online payments refer to making financial transactions over the Internet, allowing individuals and businesses to pay for goods and services electronically. This can be done through various online payment solutions, such as payment gateways, digital wallets, and online banking systems. Online payments have become increasingly popular due to convenience, speed, and security.

Online payment solutions offer a range of benefits for both consumers and businesses. For consumers, they provide a quick and easy way to complete transactions without needing physical cash or checks. For businesses, online payments streamline the payment process, reduce the risk of fraud, and enable them to reach a global customer base.

Payment gateways play a crucial role in online payments by securely transmitting payment information between the customer, the merchant, and the financial institution. They use encryption and other security measures to protect sensitive data, ensuring that transactions are safe and secure.

Digital wallets, such as Apple Pay and Google Pay, offer additional convenience and security. They allow customers to store their payment information in a secure digital format, making it easy to complete transactions with just a few clicks or taps.

Overall, online payments are an essential component of modern e-commerce, providing a secure and efficient way for businesses to accept payments and for customers to make purchases.

The Payment Gateway: Your E-Commerce Store’s Intermediary

A secure payment system bridges an online store and the financial networks that process payments. It encrypts sensitive card data, routes transaction information to the appropriate parties, and sends authorisation responses back to the merchant. Payment gateways help protect customer information and reduce the risk of fraud.

When a customer purchases, the payment gateway quickly validates the card details and checks for sufficient funds. It then sends this data to the payment processor for further action. Many gateways offer additional features like recurring billing, saved payment methods, and currency conversion to improve the checkout experience.

Merchant Accounts and Payment Processors: Behind the Scenes

A merchant account is a special bank account that allows businesses to accept credit and debit card payments. It holds funds from card transactions before transferring them to the merchant’s regular bank account. Payment processors work with merchant accounts to handle the technical aspects of moving money between banks.

Payment processors communicate with card networks and issuing banks to complete transactions. They manage the complex behind-the-scenes work of verifying funds, transferring money, and handling chargebacks. Processors also provide tools for reporting and analysis, helping merchants track sales and manage their finances more effectively.

Securing Online Payment Processes

Protecting customer data and financial information with a secure online payment solution is critical for online stores. Robust security measures and advanced encryption techniques form the foundation of secure payment processing.

Implementing Advanced Security Measures

Strong authentication methods are essential for safeguarding online transactions. Multi-factor authentication adds an extra layer of protection by requiring users to verify their identity through multiple means. This can include something they know (password), something they have (mobile device), or something they are (biometric data).

Access control measures limit system access to authorised personnel only. Role-based access control assigns permissions based on job roles, reducing the risk of unauthorised data access. Regular security audits help identify vulnerabilities and ensure compliance with industry standards.

Secure Sockets Layer (SSL) certificates encrypt data transmitted between customers and websites. This protects sensitive information from interception by malicious actors during transit.

Encryption and Tokenisation: Protecting Payment Data

Encryption converts payment data into unreadable code, making it useless if intercepted. Advanced encryption algorithms like AES-256 provide strong protection for stored and transmitted data.

Tokenisation replaces sensitive card details with unique tokens. These tokens can be used for transactions without exposing actual card numbers. This significantly reduces the risk of data theft and fraud.

Point-to-point encryption (P2PE) secures data from the point of capture until it reaches the payment processor. This minimises the exposure of sensitive information within the merchant’s systems.

Implementing these security measures helps online stores comply with Payment Card Industry Data Security Standards (PCI DSS) and build customer trust.

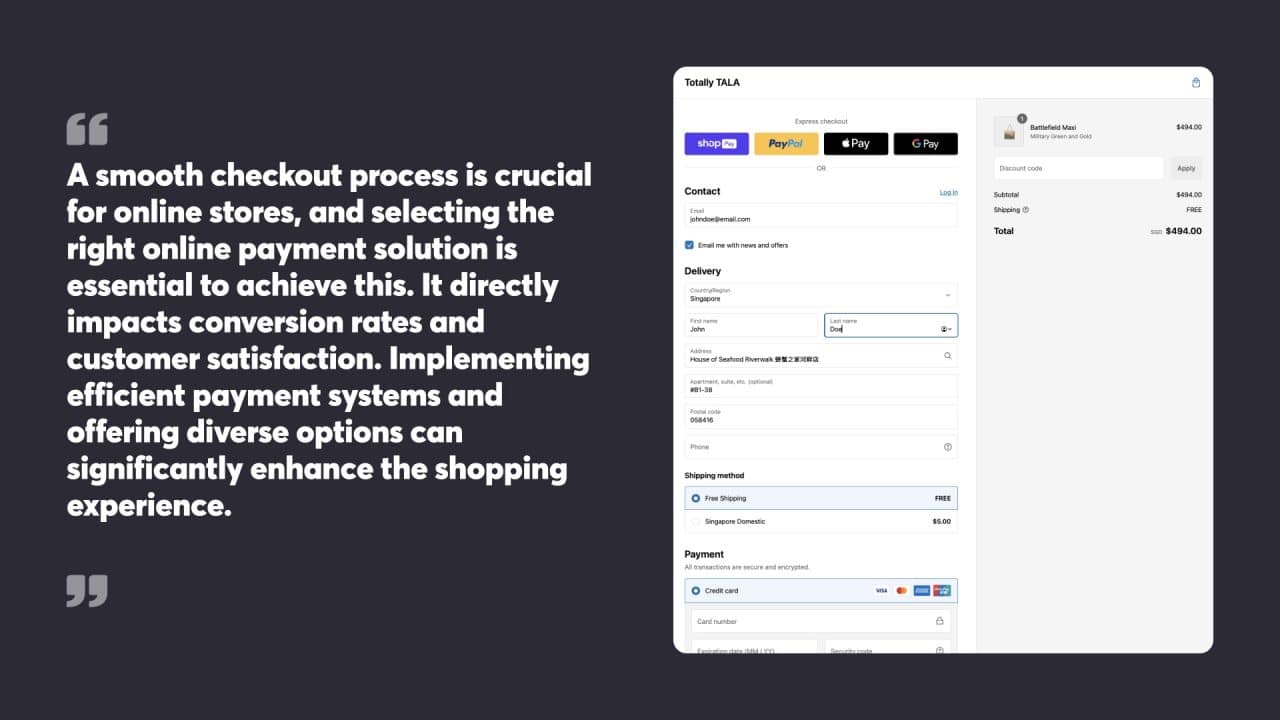

Streamlining the Customer Checkout Experience

A smooth checkout process is crucial for online stores, and selecting the right online payment solution is essential. It directly impacts conversion rates and customer satisfaction. Implementing efficient payment systems and offering diverse options can significantly enhance the shopping experience.

Optimising for Multiple Payment Methods

Online retailers benefit from providing a range of payment options. Credit and debit cards remain popular, while digital wallets like PayPal and Apple Pay are gaining traction. Offering instalment plans or buy-now-pay-later services can also boost sales.

Integrating these options requires careful planning. The checkout page should display all available methods, while icons or logos can help customers quickly identify their preferred choice. A clean, uncluttered design prevents confusion.

Security is paramount, which means implementing SSL certificates and complying with PCI DSS standards will build trust. Clear communication about security measures reassures cautious shoppers.

Contactless and Mobile Payments: A Seamless Approach

With the rapid growth of mobile commerce, optimising the checkout experience for smartphone users has become essential. Responsive design ensures that checkout pages adapt seamlessly to smaller screens, while large, touch-friendly buttons enhance usability and minimise input errors.

Contactless payments take the streamlined process a step further. By leveraging Near Field Communication (NFC) technology, customers can complete transactions with a simple tap of their phone or card. This lightning-fast approach particularly appeals to time-pressed shoppers who value convenience above all else.

Mobile wallets like Apple Pay and Google Pay offer the perfect blend of convenience and security. These digital payment solutions securely store payment information, eliminating the need for customers to enter their details for each purchase manually. Integrating biometric authentication, like fingerprint or facial recognition, adds an extra layer of protection against unauthorised access.

Another emerging trend in mobile payments is the use of QR codes. This technology is effortless to implement and use, making it an attractive option for merchants and customers. By simply scanning a QR code displayed on the checkout page, customers can complete their purchase in a matter of seconds without the need for any additional hardware or software.

Managing Recurring and One-Off Payments

Online stores benefit from offering both recurring and one-off payment options. These payment types cater to customer needs and business models, enhancing flexibility and revenue potential.

Facilitating Subscription Models with Recurring Payments

Recurring payments form the backbone of subscription-based businesses. They allow customers to sign up for regular services or products without manual intervention for each transaction. This model suits streaming platforms, software-as-a-service providers, and membership-based organisations.

Businesses need a payment gateway that supports this feature to set up recurring payments. The gateway securely stores customer payment information and processes charges at set intervals. Choosing a system that can handle failed payments, updates to card details, and cancellations is crucial.

Businesses should communicate the terms of recurring payments to customers. This includes the amount, frequency, and duration of charges. Providing an easy way for customers to manage or cancel their subscriptions builds trust and complies with consumer protection laws.

Ensuring Security for Single Transactions

One-off payments are essential for e-commerce stores selling individual products or services. These transactions require robust security measures to protect the business and the customer.

Implementing SSL encryption for all payment pages is non-negotiable. This technology safeguards sensitive data as it travels between the customer’s browser and the payment processor. Using trusted payment gateways that comply with PCI DSS standards adds an extra layer of protection.

Multi-factor authentication can further secure one-off payments. This might involve sending a code to the customer’s mobile phone or email for verification before completing the transaction. While this adds a step to checkout, it significantly reduces the risk of fraudulent purchases.

It’s wise to display security badges and certifications prominently on checkout pages. This reassures customers that their payment information is safe, potentially increasing conversion rates.

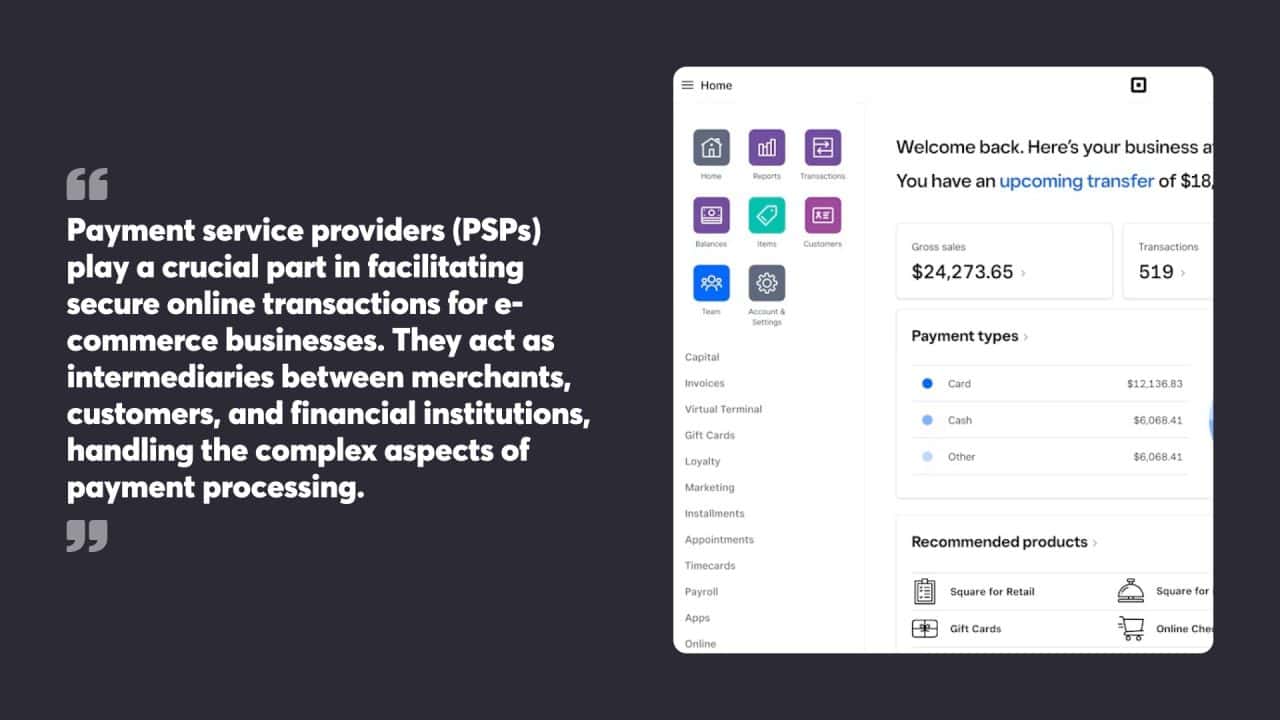

The Role of Payment Service Providers

Payment service providers (PSPs) are crucial in facilitating secure online transactions for e-commerce businesses. They act as intermediaries between merchants, customers, and financial institutions, handling the complex aspects of payment processing.

Choosing the Right Payment Gateway Provider

Selecting an appropriate payment gateway provider is vital for online stores. PSPs offer various features like support for multiple payment methods, fraud detection tools, and data encryption. Businesses should compare providers based on transaction fees, security measures, and compatibility with their e-commerce platform.

Key factors to consider include:

- Processing fees and pricing structures

- Supported payment types (credit cards, digital wallets, etc.)

- Ease of integration

- Reliability and uptime

- Customer support quality

A good PSP should balance cost-effectiveness and robust security features to protect sensitive financial data.

Integrating Payment Systems into Your E-Commerce Platform

Incorporating a secure online payment solution into an online store requires careful planning and execution. Most e-commerce platforms provide plugins or modules for popular PSPs, simplifying the integration process.

Steps for successful integration:

- Choose a compatible payment gateway

- Set up a merchant account if required

- Install and configure the payment module

- Test transactions thoroughly

- Implement security best practices

It’s vital to maintain PCI DSS compliance throughout the integration process. This involves using secure connections, encrypting data, and regularly updating security protocols. Proper integration helps create a smooth checkout experience for customers while safeguarding their payment information.

Mitigating Risks in Online Financial Transactions

Protecting online financial transactions demands robust security measures and careful handling of sensitive data. Effective risk mitigation strategies focus on identifying potential threats and safeguarding customer information.

Identifying and Preventing Security Breaches

E-commerce stores face constant threats from cybercriminals seeking to exploit vulnerabilities in payment systems. Regular security audits help spot weaknesses before they can be exploited. Implementing multi-factor authentication adds an extra layer of protection for customer accounts.

Monitoring transaction patterns can flag suspicious activities. Machine learning algorithms can detect anomalies in purchasing behaviour, alerting security teams to possible fraud attempts. Encrypting data in transit and at rest makes it harder for hackers to intercept or access sensitive information.

Keeping software and systems up-to-date with the latest security patches closes known vulnerabilities. Staff training on recognising phishing attempts and social engineering tactics is crucial in preventing human error-based breaches.

Handling Sensitive Data with Care

Proper customer data management is vital for maintaining trust and complying with privacy regulations. Limiting data collection to essential information reduces the potential impact of breaches. Storing sensitive data such as credit card details in separate, highly secure systems minimises risk.

Using tokenisation for payment processing replaces actual card numbers with unique identifiers, protecting the original data. Implementing strict access controls ensures only authorised personnel can view or handle sensitive information.

Regular data purges remove outdated or unnecessary information, reducing the data footprint exposed to potential breaches. Clear privacy policies inform customers about data handling practices, building confidence in the e-commerce store’s commitment to security.

Reducing Chargebacks and Disputes

Chargebacks and disputes can be a significant concern for businesses that accept online payments. A chargeback occurs when a customer disputes a transaction and requests a refund from their bank or credit card company. To reduce chargebacks and disputes, businesses can implement various strategies, such as:

- Displaying Refund and Return Policies: Make sure your refund and return policies are easy to find and understand. Clear policies help set customer expectations and reduce the likelihood of disputes.

- Providing Detailed Product Descriptions and Images: Accurate and detailed product descriptions and high-quality images can help prevent misunderstandings and ensure customers know exactly what they are purchasing.

- Offering Secure Payment Options: Implementing secure payment options, such as tokenisation and encryption, can help protect customer data and reduce the risk of fraudulent transactions.

- Responding Promptly to Customer Inquiries and Concerns: Providing excellent customer service can help resolve issues before they escalate into disputes. Responding quickly and professionally to customer inquiries can build trust and prevent chargebacks.

- Implementing a Robust Dispute Resolution Process: A clear and efficient process for handling disputes can help resolve issues quickly and fairly, reducing the likelihood of chargebacks.

Businesses can minimise the risk of chargebacks and disputes by taking these steps, protecting their revenue and reputation. Effective communication, secure payment processes, and excellent customer service are key to reducing the impact of chargebacks on your business.

Payment Processing Options

When it comes to online payment processing, businesses have a range of options to choose from. Each option has its advantages and disadvantages, and the right choice will depend on the specific needs and goals of the business.

Exploring Various Payment Processing Solutions

There are several payment processing solutions available, including:

- Payment Gateways: These online platforms facilitate payment transactions between a business and its customers. Examples of payment gateways include PayPal, Stripe, and Authorize.net. Payment gateways offer fraud detection, data encryption, and support for multiple payment methods.

- Merchant Accounts: These are specialised bank accounts that allow businesses to accept credit and debit card payments. Merchant accounts can be obtained through banks or payment processors. They provide the infrastructure needed to process card payments and manage funds.

- Online Payment Processors: These companies specialise in processing online payments, such as Square and Adyen. They offer comprehensive payment solutions, including payment gateways, merchant accounts, and additional services like reporting and analytics.

- Digital Wallets: These services allow customers to store their payment information and make transactions online, such as Apple Pay and Google Pay. Digital wallets provide customers a convenient and secure way to pay, often using biometric authentication for added security.

When choosing a payment processing solution, businesses should consider factors such as security, fees, and integration with their existing systems. By selecting the right payment processing solution, companies can provide their customers a seamless and secure payment experience.

In conclusion, understanding the various payment processing options and selecting the right one for your business is crucial for providing a secure and efficient payment experience. By carefully evaluating your needs and the features offered by different solutions, you can ensure that your online store is equipped to handle transactions smoothly and securely.

Legal Compliance and Best Practices

Online stores must prioritise legal compliance and adopt best practices for secure payment processing. This safeguards customer data, builds trust, and protects businesses from financial losses and reputational damage.

Adhering to International Standards for Payment Processing

The Payment Card Industry Data Security Standard (PCI DSS) is a crucial set of requirements for businesses handling credit card information. Compliance involves implementing security measures like data encryption, access controls, and regular system testing. Online stores should use PCI-compliant payment solutions and conduct yearly assessments to maintain compliance.

Businesses must also comply with regional regulations such as the General Data Protection Regulation (GDPR) in the European Union. This involves obtaining explicit consent for data collection, implementing data minimisation practices, and giving customers control over their personal information.

Ensuring Transparency in Transaction Approval

Clear communication about transaction approval processes builds customer trust and reduces disputes. Online stores should display their security certifications and explain the steps involved in payment processing.

Implementing multi-factor authentication adds an extra layer of security. This can include SMS verification codes or biometric checks. Businesses should also use fraud detection tools to flag suspicious transactions for manual review.

Clear refunds, chargebacks, and dispute resolution policies should be easily accessible on the website. This transparency helps customers understand their rights and reduces potential conflicts.

As you navigate the complexities of secure payment processing for your online store, partnering with a trusted website development company like ours can help you create a seamless and secure e-commerce platform that instils confidence in your customers and drives your business growth.

Contact us today to help move your website visitors from checking you out to the checkout.